Retail is navigating a dynamic shift between online and In-Store shopping channels. From large U.S. department stores to e-commerce start-ups, every retailer is adjusting to evolving consumer preferences. For example, a major electronics chain sees increased online orders of high-ticket items, while a regional apparel brand reports higher foot traffic for In-Store try-ons. Let’s explore the latest data and trends to understand how consumers are choosing where, and how, they shop.

Editor’s Choice

- In 2024, U.S. consumers spent $5.93 trillion In-Store and $1.34 trillion online.

- In 2025 Q2, e-commerce accounted for about 15.5% of U.S. retail sales.

- Global online retail sales are projected to reach $7.4 trillion in 2025.

- In 2025, for the U.S., 21% of retail purchases are expected to take place online.

- Retail executives expect U.S. retail industry growth by mid-single digits in 2025.

- Over 90% of U.S. consumers surveyed in 2025 reported shopping at an online-only retailer in the past month.

- In 2024, 85% of US consumers shopped online, and 99% shopped In-Store.

Recent Developments

- In 2024 Q4, U.S. e-commerce sales rose by 21.4% from the previous quarter.

- In June 2025, the e-commerce share of monthly retail sales dollars in the U.S. declined by 13.8% from its December 2024 peak.

- A U.S. retail survey in 2025 shows consumer sentiment remains weaker than in early 2020, yet spending continues.

- The global shift to digital is deepening, and more shopping time and spending is going online than before.

- Analysts note that the “online vs In-Store” divide is less binary; more consumers engage in hybrid behaviour.

- Retailers are doubling down on omnichannel capabilities (e.g., BOPIS, click and collect) to bridge online and in-store gaps.

- In the U.S., In-Store sales in 2024 increased by approximately 0.93%, while e-commerce sales rose by about 8.64%.

- Online shoppers globally numbered approximately 2.77 billion by 2025.

Market Share: Online vs In-Store Retail Sales

- In-Store retail sales in the U.S. in 2024 were $5.93 trillion, and online, $1.34 trillion.

- From 2018 to 2024, U.S. In-Store retail sales dollars rose from approximately $4.59 trillion to $5.93 trillion.

- The share of online retail sales in the U.S. is rising, but sis still much lower than In-Store.

- Global forecast, online retail is expected to account for about 24% of total global retail in 2025.

- In the U.S., e-commerce growth in recent quarters continues to outpace many In-Store segments.

- Retail executives expect digital commerce to be a primary growth engine in 2025.

- A large portion of consumers still prefer In-Store shopping; in 2024, 45% reported primarily shopping in brick-and-mortar stores.

- Survey data indicate that in 2025, the U.S. online shopping channel owes much of its strength to convenience rather than novelty.

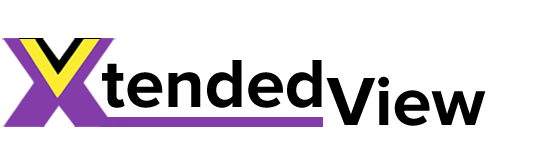

What We Buy Online vs. In-Store

- For Groceries (Perishables), 85% shop in-store, while only 7% purchase online, and another 7% use both, making this a category with one of the highest overall shopping rates (94%).

- For Groceries (Non-perishables), 75% buy in-store, 16% use both, and 9% shop online, showing that it is also widely purchased (94%).

- In Clothing, the split is more balanced,d with 29% shopping in-store, 39% using both, and 32% buying online, resulting in high engagement (87%).

- For Paper Products, 75% purchase in-store, 13% use both, and 12% buy online, contributing to 85% having shopped in the past 3 months.

- With Cleaning Supplies, 74% shop in-store, 11% use both, and 15% shop online, leading to 82% having recently purchased.

- In Beauty Products, 42% shop in-store, 28% use both, and 31% buy online, supporting a 75% overall shopping rate.

- For Gifts, there is a strong online trend with 44% buying online, 37% using both, and only 19% purchasing in-store, while 71% have shopped the category.

- In Books & Media, the majority (66%) shop online compared to 17% each for in-store and both, resulting in 71% overall shopping.

- For Electronics & Accessories, 52% shop online, 24% use both, and 25% shop in-store, with 67% having purchased in the category.

- In Pet Food, 61% buy in-store, 21% purchase online, and 17% use both, matching a 61% shopping rate.

- With Art & Home Decor, 39% buy online, 41% shop in-store, and 20% use both, while 57% have shopped the category.

- For Shoes, Sunglasses, & Handbags, shopping is fairly balanced with 37% online, 37% in-store, and 26% using both, adding up to 54% having shopped.

- In Home & Garden, 62% shop in-store, 20% buy online, and 19% use both, while 54% made purchases in the category.

- For Office Products, 43% shop in-store, 38% buy online, and 19% use both, contributing to 52% shopping overall.

- In Auto Parts & Accessories, 59% shop in-store, 25% buy online, and 16% use both, marking the lowest category rate at 48%.

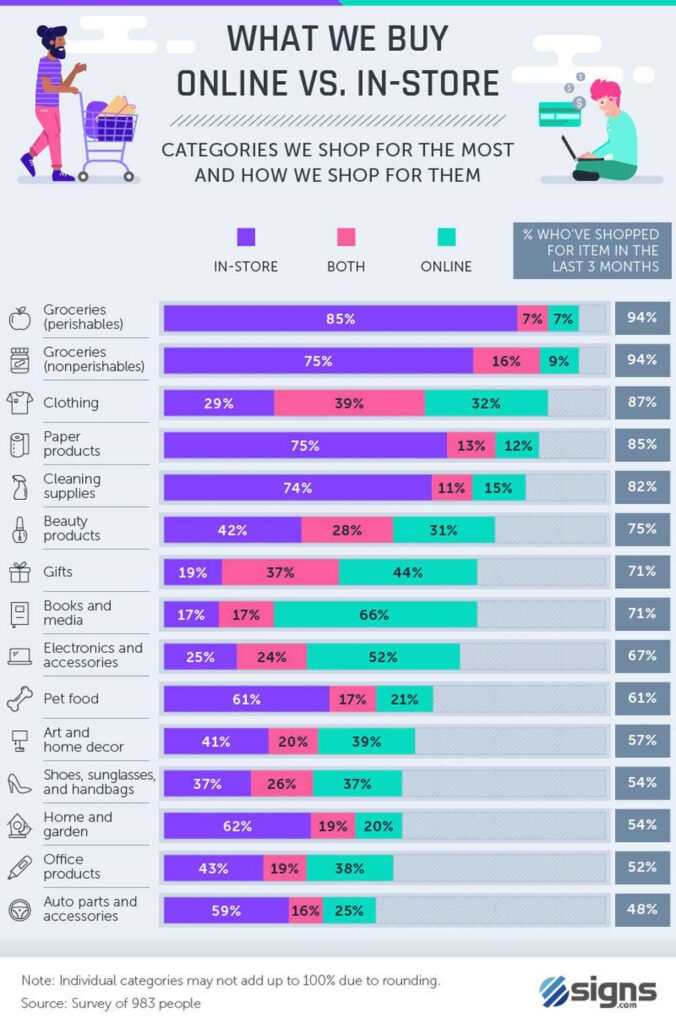

Online Shopping Growth Trends and Projections

- Global e-commerce sales are projected to surpass $6.86 trillion in 2025.

- In 2025, 21% of U.S. retail purchases are expected to happen online, up from a lower share in 2024.

- The growth rate for e-commerce globally is forecast at about 7.8% CAGR from 2025 to 2027.

- U.S. industry reports show e-commerce sales in 2024 increased approximately. 8.64% over 2023.

- Quarterly data, in U.S. Q2 2025, e-commerce sales increased 6.24% from the previous quarter.

- Among online shoppers globally, 34% shop online at least once a week.

- Over 2.77 billion people globally are expected to shop online in 2025.

- As online retail grows, the margin for differentiation in logistics, fulfilment, and experience becomes more critical.

In-Store Shopping Trends and Sales Growth

- U.S. in-store retail sales increased about 0.93% in 2024 over 2023.

- In Q2 2025, U.S. in-store sales increased 9.20% from the previous quarter.

- A projected 80.8% of U.S. retail sales are expected to occur in brick-and-mortar stores in 2025.

- Among consumers, 64% shop in-storeevery weeks (in the U.S., 2024 data).

- 62% of consumers primarily buy groceries in-store.

- 50% of consumers primarily buy personal care and beauty products in-store.

- 40% of consumers primarily buy apparel and footwear in-store.

- Analysts note that physical retail is shifting its value proposition toward experience, service, and immediacy rather than simply location.

Demographic Preferences: Who Shops Online vs In-Store

- 33.3% more Baby Boomers primarily shop in-store compared to all shoppers.

- 14.3% more Millennials primarily shop online compared to all shoppers.

- Among Gen Z, 36% regularly shop both online and in-store (hybrid).

- Given the option, 37% of Gen Z prefer to shop in-store and 28% prefer online.

- In 2021, 49% of Millennials shopped in-store weekly, 44% shopped online weekly.

- For Gen X, 51% preferred in-store, 27% preferred online.

- In 2025, younger consumers are more comfortable blending online and physical channels.

- Retailers must tailor channel strategy by age segment, older shoppers still favour physical, younger shoppers favour digital or hybrid.

Shopping Frequency: Online vs In-Store

- In the United States, about 49% of consumers shopped online at least once per week in 2024, down from 57% in 2023.

- In 2024, 12% of U.S. consumers shopped online daily.

- Weekly in-store shopping visits were reported by around 64% of U.S. shoppers in 2025.

- Among consumers aged 55 and older, 62% expressed a preference for in-store shopping in 2024.

- In 2024, 68% of online shoppers globally used mobile devices for purchases.

- U.S. online shoppers surveyed in 2025 reported that over 90% had made at least one purchase in the previous month from an online-only retailer.

- Hybrid behaviour is increasing and impacts total visit counts.

- Retailers state that boosting frequency requires optimising both channels.

Consumer Reasons for Online Shopping

- Over 90% of respondents in 2025 said they had shopped at an online-only retailer in the prior month.

- Online shoppers globally reached 2.77 billion by 2025.

- Convenience, comparison, and home delivery drive online growth.

- The average U.S. annual online growth rate (2014,2024) was 13.4%.

- Online shopping offers a broader product selection and inventory visibility.

- Digital wallets drove 53% of global online purchases in 2024.

- 33% of consumers shop via YouTube and 32% via TikTok.

Consumer Reasons for In-Store Shopping

- U.S. in-store retail sales reached $5.93 trillion in 2024.

- 62% of older consumers preferred in-store shopping in 2024.

- 64% of consumers enjoy in-store shopping to see, touch, and try products.

- Impulse purchases account for 40% to 80% of retail sales in stores.

- 51% of overall consumers prefer the tactile and personal in-store experience.

- 50%-62% of shoppers prefer buying groceries and personal care products in-store.

- In-store pickup increases store foot traffic and cross-sales significantly.

- 53% of consumers find in-store shopping more enjoyable due to the ambience and service.

- About 68% of shoppers seek expert advice available only in-store for high-value items.

- Shopping as an outing influences many, with around 45% of consumers choosing in-store for the experience.

Hybrid Shopping Behaviours (Omnichannel, BOPIS, Click and Collect)

- 72% of U.S. consumers have used BOPIS, and 52% use it monthly.

- Click and collect sales in 2025 are projected to reach $154.3 billion, 16.2% annual growth.

- The BOPIS market was valued at $16.88 billion in 2024 and is projected to reach $34.17 billion by 2033.

- Retailers offering BOPIS report 30% higher in-store traffic and 25% larger basket size.

- 43% use BOPIS to avoid delivery charges.

- Omnichannel retailers see 250% higher engagement.

- Consumers expect seamless transitions between browsing, pickup, and fulfilment.

- Hybrid models reduce reliance on purely online or purely in-store channels.

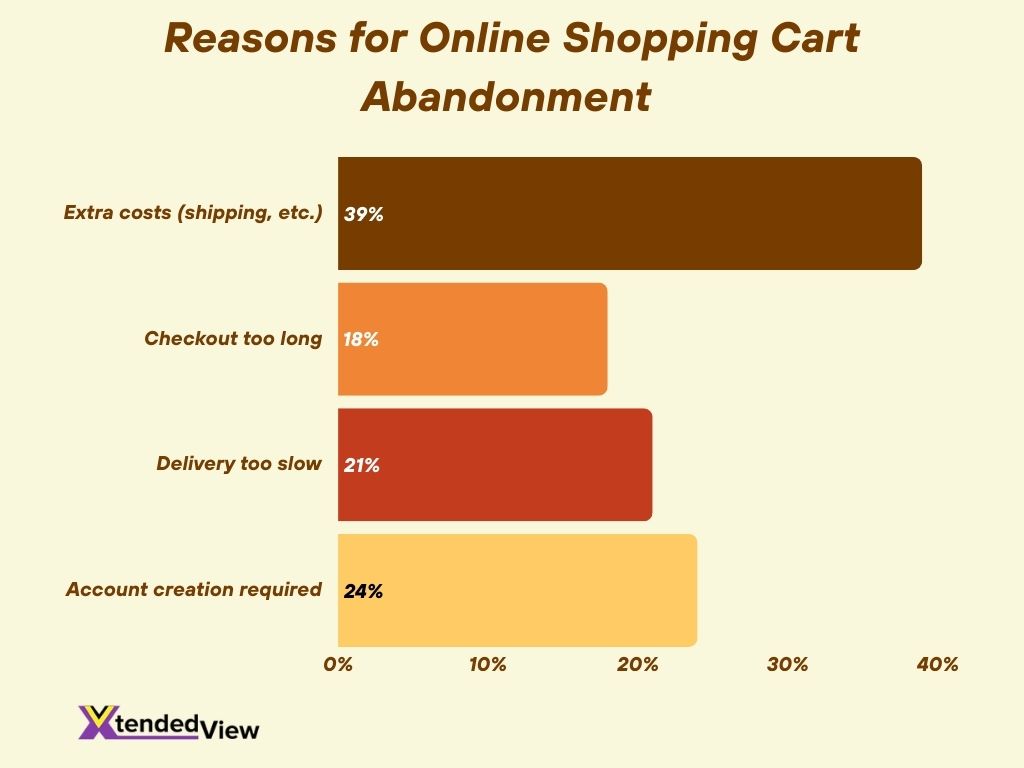

Shopping Cart Abandonment Statistics

- The average online cart abandonment rate in 2024 was 70.19%.

- 39% abandon due to extra costs (shipping, taxes, fees).

- 18% abandon because checkout is too long or complicated.

- 21% leave because delivery is too slow.

- 24% abandon when forced to create an account.

- Mobile cart abandonment reached 85.65%.

- Recoverable abandoned cart value is estimated at $260 billion in the U.S. and the EU.

- Improved checkout UX can raise conversion by 35%+.

Mobile Commerce and Shopping Behaviour

- Global m-commerce sales are projected to reach $2.51 trillion in 2025.

- M-commerce will represent around 59% of all e-commerce sales in 2025.

- More than 75% of U.S. adults will have made a smartphone purchase by 2025.

- There are 1.65 billion global mobile shoppers in 2025.

- Mobile apps convert better than mobile websites (approx. 3.5% vs 2%).

- 40% of users will switch to a competitor after a bad mobile experience.

- Improved mobile optimisation boosts repeat visits and session durations.

- Mobile transaction share spikes during holiday periods.

Holiday Shopping Patterns: Online vs In-Store

- U.S. holiday retail sales in 2025 are forecast at $1.61–$1.62 trillion, 2.9%–3.4% growth.

- Nearly 40% of shoppers plan to split their holiday shopping between online and in-store, while 80% still prefer in-store.

- Many U.S. shoppers begin holiday shopping earlier in 2025.

- Omnichannel fulfilment is a key holiday trend.

- In-store “seal the deal” moments remain important for many gift purchases.

- Click and collect rises sharply due to delivery concerns.

- Inflation is causing shoppers to delay discretionary purchases until discounts appear.

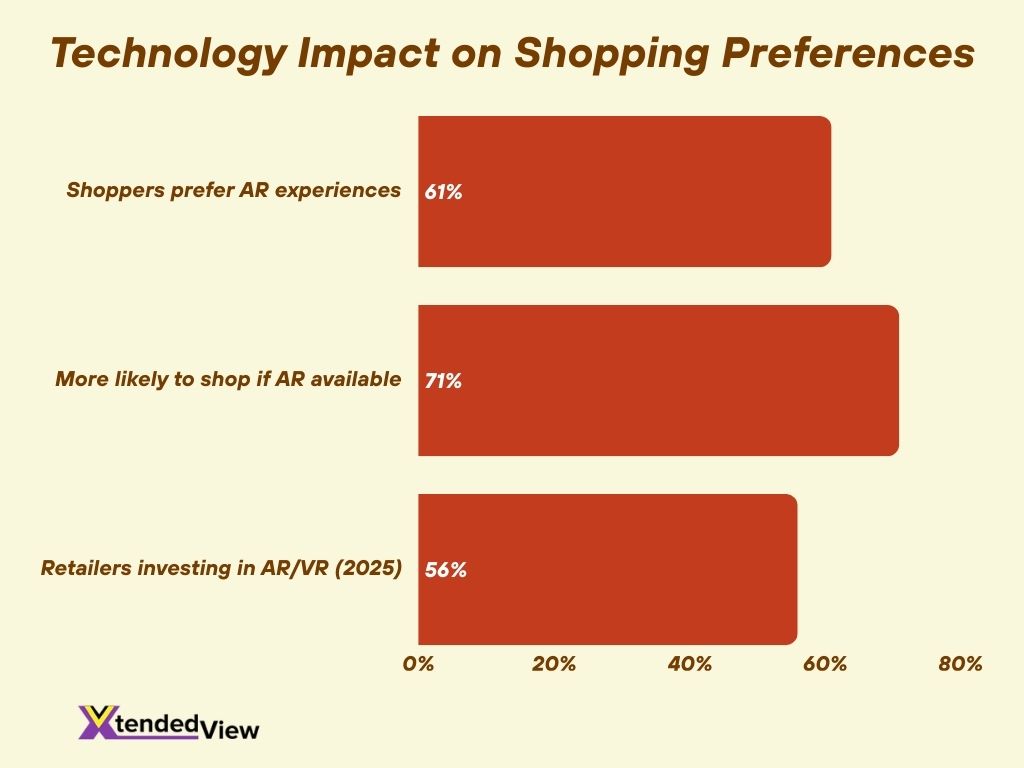

Technology Impact: AI, AR, VR, Voice, Social Commerce

- 61% of shoppers prefer retailers that offer AR experiences.

- 71% would shop more often if AR were available.

- 56% of retailers planned AR and VR investments by 2025.

- Social commerce accounts for nearly 20% of e-commerce sales.

- Multichannel shoppers spend about 1.7x more than single-channel shoppers.

- Immersive tech can boost conversion by 200% for certain product categories.

- Voice commerce usage continues rising among younger demographics.

- AI recommendation engines and virtual try-ons are major investment priorities.

Loyalty Programs and Customer Experience Trends

- Over 90% of companies globally have a loyalty or rewards program.

- The loyalty management market reached $15.19 billion in 2025, projected to reach $41.21 billion by 2032.

- 88% of CX professionals say product quality drives loyalty, 85% say experience itself does.

- Personalised reward redemption results in 4.3x higher spend.

- 63% of program owners say they are satisfied with program performance.

- Hyper-personalisation and convenience are key for U.S. loyalty success.

- Brands are shifting loyalty to relationship building and experiential rewards.

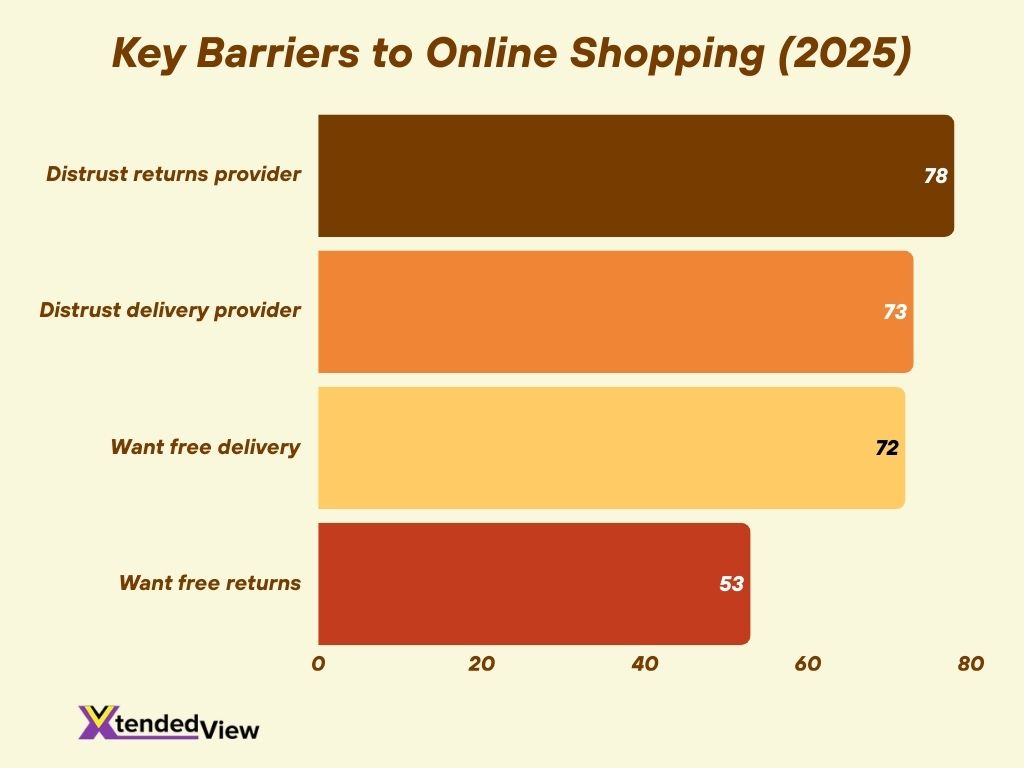

Barriers to Online Shopping (Returns, Delivery, Trust)

- 73% will not buy online if they do not trust the delivery provider.

- 78% will not buy if they do not trust the returns provider.

- 72% say free delivery would improve the online experience, 53% say free returns would.

- Lack of physical inspection and privacy concerns reduce online trust.

- Shipping cost and complexity are major friction points.

- Tangibility needs make some categories slow to shift online.

- Cross-border logistics and infrastructure gaps limit adoption.

External Influences: Economy, Inflation, Market Disruption

- 3.4% global core inflation is projected in the second half of 2025.

- Retail sales are forecasted to grow 2.7% to 3.7% in 2025.

- Holiday retail growth is expected between 3.7% and 4.2% for 2025.

- Supply chain delivery times averaged 81 days in late 2024, a 25% increase from pre-pandemic.

- Consumers increasingly prioritise essentials and hunt for online deals amid inflation.

- Physical store foot traffic growth is modest, with indoor malls seeing around a 6.3% year-over-year increase.

- Technology-driven retail innovations contribute to 5-6% higher sales growth for adopters.

- Ecommerce retail sales are projected to reach approximately $7.4 trillion globally by 2025.

- Retailers expect to hire between 265,000 and 365,000 seasonal workers for the 2025 holiday period.

- Slower holiday momentum reflected in growth rates around 2.9% to 3.4% in certain markets.

Frequently Asked Questions (FAQs)

E-commerce made up 15.5% of total U.S. retail sales in Q2 2025.

Global e-commerce sales are projected to reach about $7.4 trillion in 2025.

Roughly 21% of all retail purchases are expected to occur online in 2025.

The CAGR for global e-commerce from 2025-2027 is projected at around 7.8%.

Mobile commerce is expected to account for about 59% of total online retail sales in 2025.

Conclusion

The retail landscape reflects a dynamic interplay between online and In-Store shopping. Mobile commerce continues its rapid ascent, while holiday shopping habits reveal a strong omnichannel orientation. Immersive technologies, loyalty programmes and seamless experiences are becoming key differentiators. Yet barriers such as trust, delivery and cost pressures persist.

External economic forces, like inflation and supply chain stress, are nudging both consumers and retailers to adapt. Ultimately, retailers that blend online agility with In-Store experience, supported by technology and meaningful loyalty, are best positioned for success. Explore the full article to understand each dimension in detail.