As machine learning (ML) powers deeper into business and technology workflows, this year marks a pivotal moment. Whether it’s optimizing logistics in supply‑chain operations or enabling real‑time fraud detection in financial services, ML is no longer marginal. From health diagnostics to retail automation, ML is redefining how industries work. With each algorithm trained and deployed, the ecosystem grows smarter, faster, and more accurate.

Editor’s Choice

- The global machine‑learning market size is projected to reach $93.95 billion in 2025, up markedly from 2024.

- Organizations reporting use of AI/ML in at least one business function rose to 78% in 2024, up from 55% a year earlier.

- The market for automated machine learning (AutoML) is estimated at $4.65 billion in 2025, with high growth expected.

- North America held roughly 32% of the global ML market share in 2024 and is expected to remain dominant.

- The ML market’s compound annual growth rate (CAGR) between 2025 and 2034 is estimated at ~35% in some forecasts.

- Enterprises using ML models across multiple business functions average three functions per organization.

- The share of large enterprises leading ML deployments stands at over 65% of market revenue share in certain reports.

Recent Developments

- In 2025, most enterprises shifted ML and AI from pilot mode to customer‑facing applications, beyond internal optimization.

- The average time to train ML models has dropped significantly owing to better hardware and cloud‑based services.

- Low‑code and AutoML platforms are gaining traction, enabling non‑data‑scientist teams to deploy ML workflows at scale.

- Many organisations are now using ML model‑explainability tools (such as SHAP/LIME) and monitoring frameworks to manage production risk.

- Surveys indicate enterprises are increasingly measuring value from ML adoption, with 88% stating they measure some derived value.

- ML governance, ethics, and risk management are emerging as strategic priorities in deployment discussions.

- More organisations report ML in three or more business functions, up from being limited to one area.

- The rise in use of generative and agent‑based AI models is pushing new ML infrastructure demands.

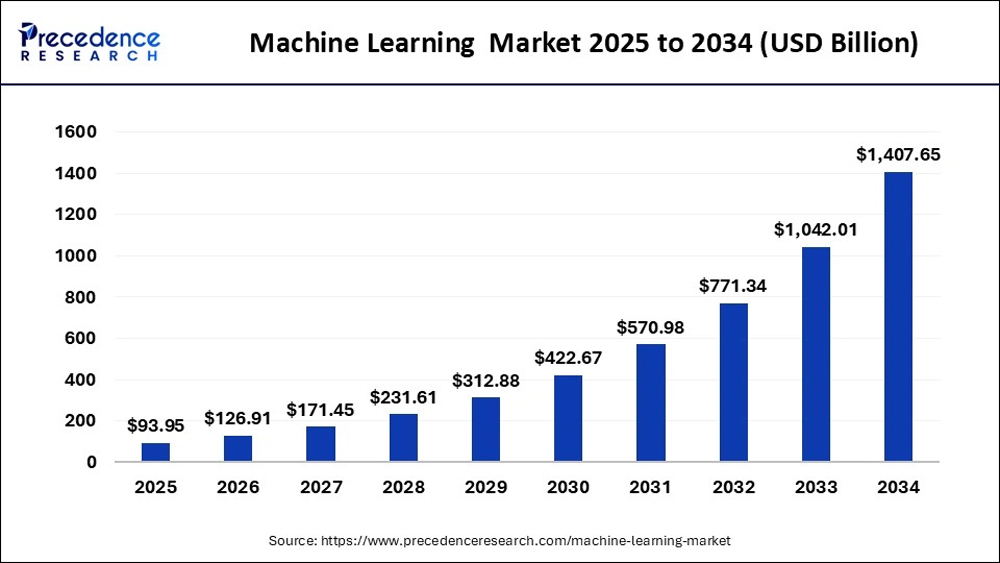

Global Machine Learning Market Size

- The global Machine Learning (ML) market is projected to grow from $93.95 billion in 2025 to an impressive $1,407.65 billion by 2034.

- This represents an approximate 15x increase over the 10-year forecast period, showing massive exponential growth.

- Year-by-year projections (USD Billion):

- 2025: $93.95

- 2026: $126.91

- 2027: $171.45

- 2028: $231.61

- 2029: $312.88

- 2030: $422.67

- 2031: $570.98

- 2032: $771.34

- 2033: $1,042.01

- 2034: $1,407.65

- The fastest acceleration begins after 2030, when the market surpasses $500 billion, indicating that the second half of the decade will experience the most rapid expansion.

- From 2025 to 2030, the market grows by about 4.5x, while from 2030 to 2034, it nearly triples again.

- The trend highlights increasing adoption of AI and automation technologies, investment in data infrastructure, and the scaling of machine learning applications across industries.

- The steady year-over-year growth suggests a compound annual growth rate (CAGR) in the double digits, emphasizing sustained innovation and market confidence in AI-driven solutions.

Machine Learning Market Share by Region

- North America accounted for ~32% of the global ML market in 2024, with the highest regional revenue.

- Asia‑Pacific is projected to be the fastest‑growing region in the forecast period 2025–2034.

- Some forecasts estimate North America will hold around a 35% share by 2035 in the ML market.

- A region‑specific forecast expects Asia Pacific’s share growth driven by China and India’s digitization.

- In 2024, North America’s ML market size was estimated at $21.56 billion.

- The large‑enterprise segment in the US and Canada supports regional leadership due to advanced infrastructure.

- Some regional reports highlight Latin America, the Middle East & Africa as emerging markets, though starting from smaller bases.

- Deployment models (cloud vs on‑premise) vary by region, influencing how ML market share evolves.

Enterprise Adoption of Machine Learning

- 78% of organisations reported using AI/ML in at least one business function in 2024.

- In the same survey, usage climbed from 55% just one year earlier.

- Enterprises now report using AI/ML in an average of three business functions.

- Among these, IT functions saw usage increase from 27% to 36% in six months.

- Large enterprises capture over 65% of the market revenue share in ML deployments.

- A survey found 83.8% of enterprise data flowing into AI tools is classified as high‑risk or critical.

- While adoption is high, deployment at scale remains a challenge.

- Enterprises are increasingly centralising ML/AI budgets.

- ML‐driven initiatives now often include governance, ethics, and lifecycle management.

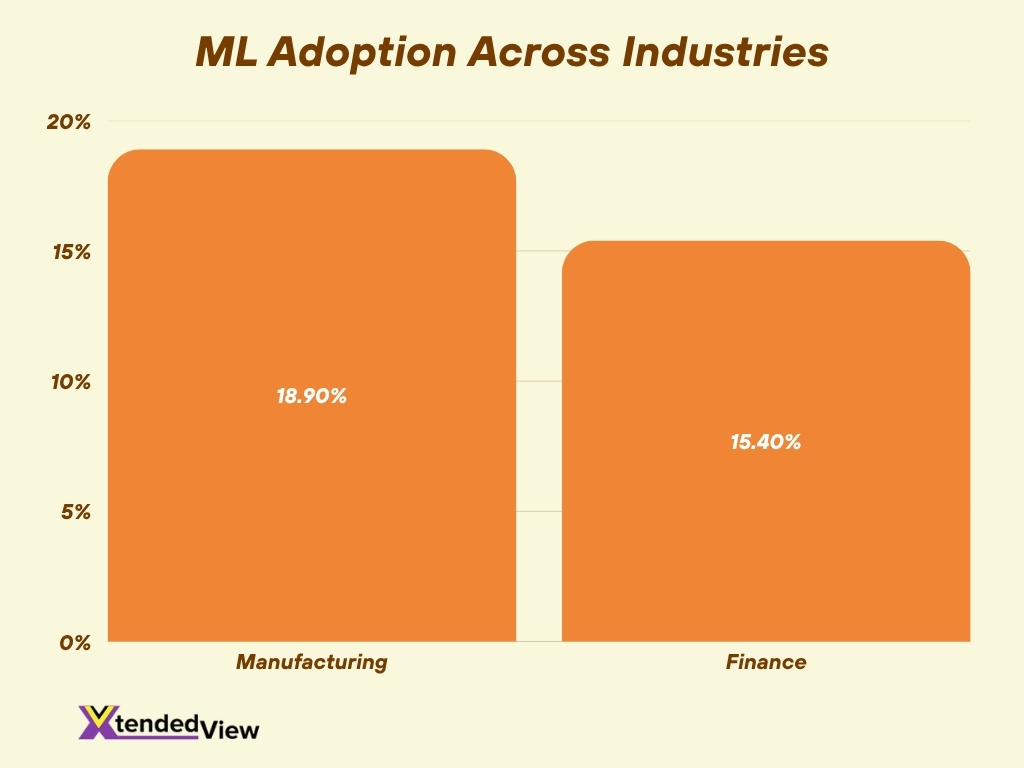

Industry‑wise Machine Learning Adoption

- In 2025, ML adoption across industries is growing by up to 20% annually.

- The manufacturing sector holds roughly 18.9% share of the ML market, followed by finance at 15.4%.

- About 49% of companies use ML/AI in marketing and sales functions.

- Only 6% of organisations have not begun exploring generative AI, meaning about 94% are either using or evaluating it.

- The automotive/manufacturing use‑case market for ML is forecasted to reach $8.78 billion by 2030.

- Industries with legacy infrastructure report slower ML adoption.

- In sectors like healthcare, ML is used for diagnostics, drug development, and patient monitoring.

- Many firms in consumer goods and retail report launching ML pilots, but fewer than 1 in 5 have moved to enterprise‑scale deployment.

- Firms indicate that the biggest barriers in industry adoption include data quality, talent shortage, and integration with legacy systems.

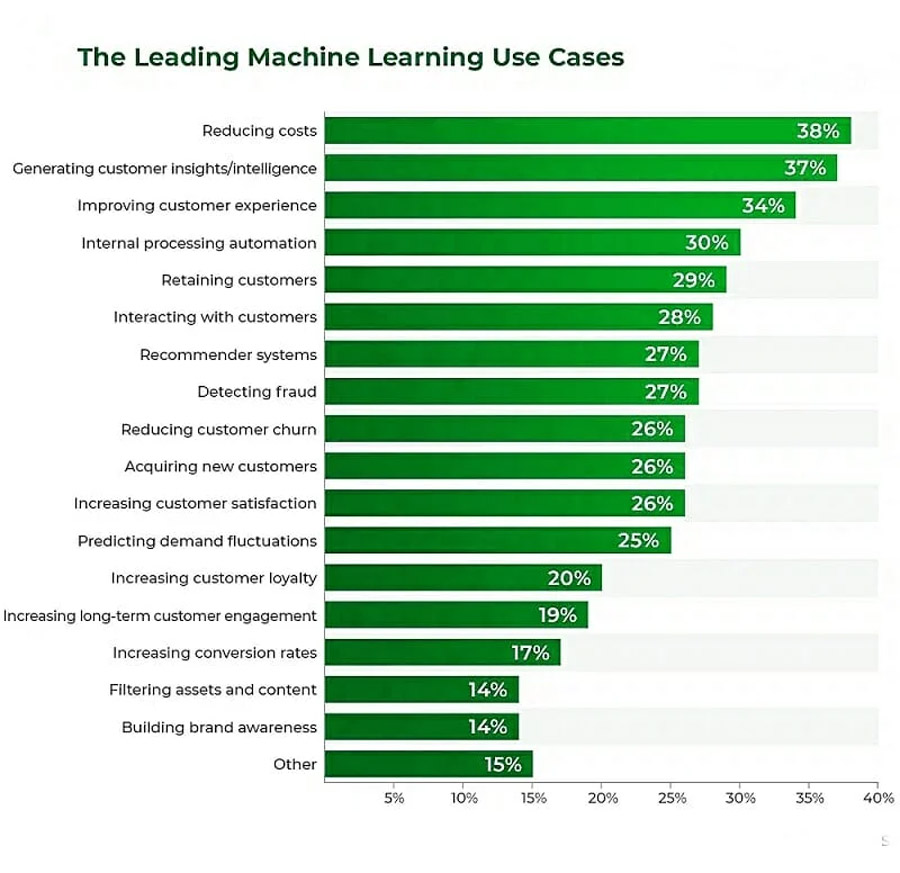

Top Machine Learning Use Cases

- Reducing costs is the top use case, cited by 38% of organizations, highlighting ML’s strong impact on operational efficiency and cost optimization.

- Generating customer insights/intelligence follows closely at 37%, showing that businesses heavily rely on ML for data-driven decision-making and market analysis.

- Improving customer experience is a major focus for 34% of companies, underlining ML’s role in personalization, customer support, and user satisfaction.

- Internal processing automation (30%) and retaining customers (29%) emphasize ML’s growing importance in workflow automation and customer lifecycle management.

- Other strong use cases include:

- Interacting with customers – 28%

- Recommender systems – 27%

- Detecting fraud – 27%

- Reducing customer churn, acquiring new customers, and increasing satisfaction – each at 26%

- Predicting demand fluctuations (25%) is critical for industries like retail, supply chain, and manufacturing, enhancing forecasting accuracy.

- Lower but still significant areas include:

- Increasing customer loyalty – 20%

- Long-term customer engagement – 19%

- Conversion rates – 17%

- Filtering assets and content – 14%

- Building brand awareness – 14%

- 15% of companies use ML for other specialized or emerging applications, reflecting ongoing innovation across various domains.

Investment and Funding in Machine Learning

- In the first three quarters of 2025, ML/AI‑focused startups raised $192.7 billion in venture capital.

- AI/ML startups represent about 34% of all VC investment.

- Private investment in generative AI in 2024 reached $33.9 billion globally, an ~18.7% increase.

- The U.S. federal government is expected to invest more than $470.9 billion in AI in 2025.

- Investment in ML infrastructure is rising by double‑digit percentages annually.

- Later‑stage ML firms are receiving larger rounds.

- Only ~5% of firms are deriving meaningful ROI from AI/ML investments.

- Larger tech firms are acquiring ML startups.

- Funding is increasingly directed toward applications vs purely research efforts.

Cloud‑Based Machine Learning Statistics

- The global cloud‑based ML platforms market is forecast to expand at a CAGR of ~36.7% between 2024 and 2029.

- The public cloud deployment mode held the largest share of the cloud‑ML platforms market in 2024.

- Asia‑Pacific dominated in cloud‑ML platform share in 2024, and North America is expected to grow fastest in 2025–2034.

- Managed services & support for cloud ML are expected to grow significantly.

- Large enterprises currently hold the maximum share in cloud‑ML deployment.

- BFSI held the largest share of cloud‑ML usage in 2024.

- The hybrid-cloud deployment mode is projected to grow significantly.

- Cloud‑ML adoption is helping reduce infrastructure burden.

- Cloud‑ML platforms increasingly integrate AutoML capabilities.

Model Accuracy and Benchmark Performance

- Enterprises report an average model performance improvement of ~18% since 2023.

- ML teams now incorporate MLOps pipelines to track model drift and accuracy decay.

- Use of explainability tools (e.g., SHAP, LIME) has grown.

- Some transformer‑based models in 2025 score above 90% on benchmark tasks.

- Training time for large models was reduced by ~30‑40%.

- The average enterprise ML model is retrained every 6‑9 months.

- Benchmarking now includes inference latency, with targets under 100 ms.

- Model fairness and bias metrics are tracked in ~50% of deployments.

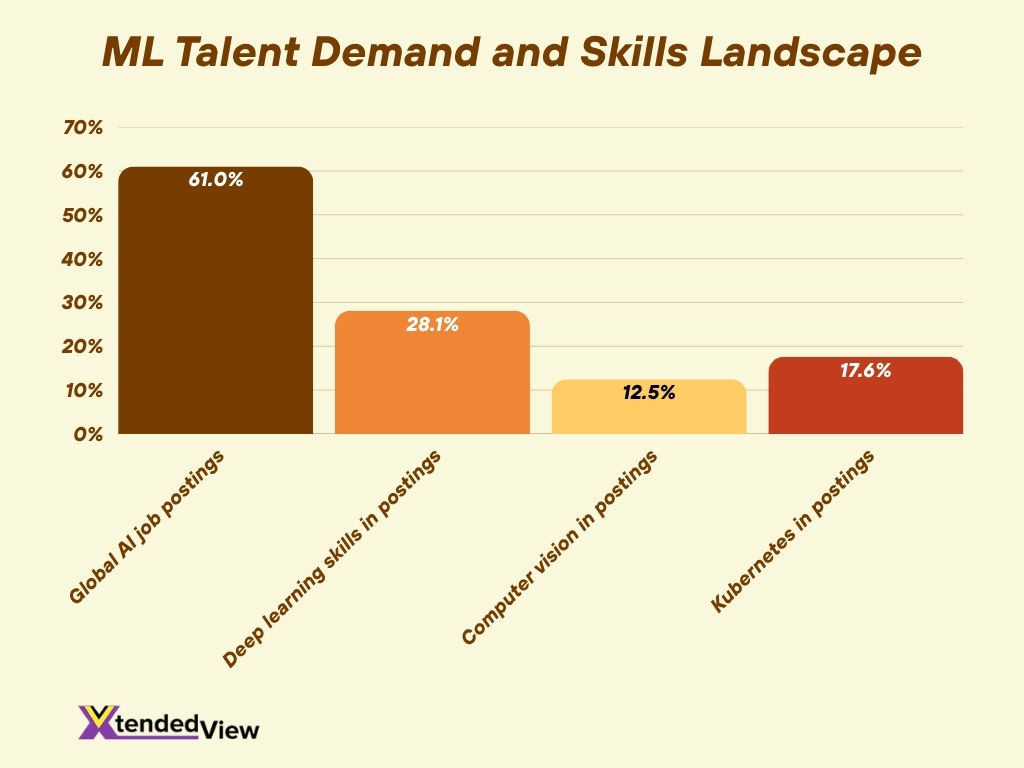

Job Market and Skills Demand in ML

- In Q1 2025, the U.S. had 35,445 AI‑related job postings, a 25.2% increase.

- The median annual salary for AI roles rose to $156,998.

- AI/ML job postings globally increased by ~61% in 2024.

- Employers expect 39% of key skills to change by 2030.

- Deep‑learning skills were in 28.1% of AI engineer job postings.

- 12.5% of postings listed computer‑vision, 17.6% listed Kubernetes.

- The U.S. data job market reached 220,000 positions.

- Technical + non‑technical skills are increasingly in demand.

- Talent gap remains a major issue.

Challenges in Machine Learning Adoption

- 45% of organizations cite data accuracy or bias as their top barrier.

- 42% of firms report insufficient proprietary data.

- 42% feel they lack generative AI expertise.

- 40% are concerned about privacy or data confidentiality issues.

- 51% of organisations experienced at least one negative consequence from AI/ML use.

- Only 33% of companies report scaling ML programmes beyond pilot stages.

- 12% of small businesses have invested in AI training, and 52% cite lack of skills as the top obstacle.

- Organisations struggle with integrating ML into legacy systems.

- Governance and explainability concerns impede deployment in regulated industries.

Ethical and Regulatory Statistics in ML

- 77% of companies consider AI/ML compliance a top priority.

- 69% have adopted responsible‑AI practices.

- One‑third of “high‑performer” firms spend more than 20% of their digital budget on AI.

- 51% experienced a negative AI/ML consequence, such as inaccuracy or bias.

- Organisations are defining human‑validation workflows.

- Regulatory frameworks are emerging for generative and agent‑based AI.

- Concerns about data ethics, bias, and transparency appear in 45% + of ML risk profiles.

Data Volume and Training Trends

- Average training dataset size is 2.3 TB in 2025, ~40% increase.

- Synthetic data accounts for 23% of training inputs.

- 78% of computer‑vision ML projects use data augmentation.

- ML‑pipeline retraining frequency is now every 9 days.

- Labelled‑data cost per 1,000 samples is $9.82.

- Training time for large models reduced by 31%.

- Dataset sizes for language models have grown 3.7× per year since 2010.

- Publicly available human data may soon be exhausted, increasing reliance on synthetic sources.

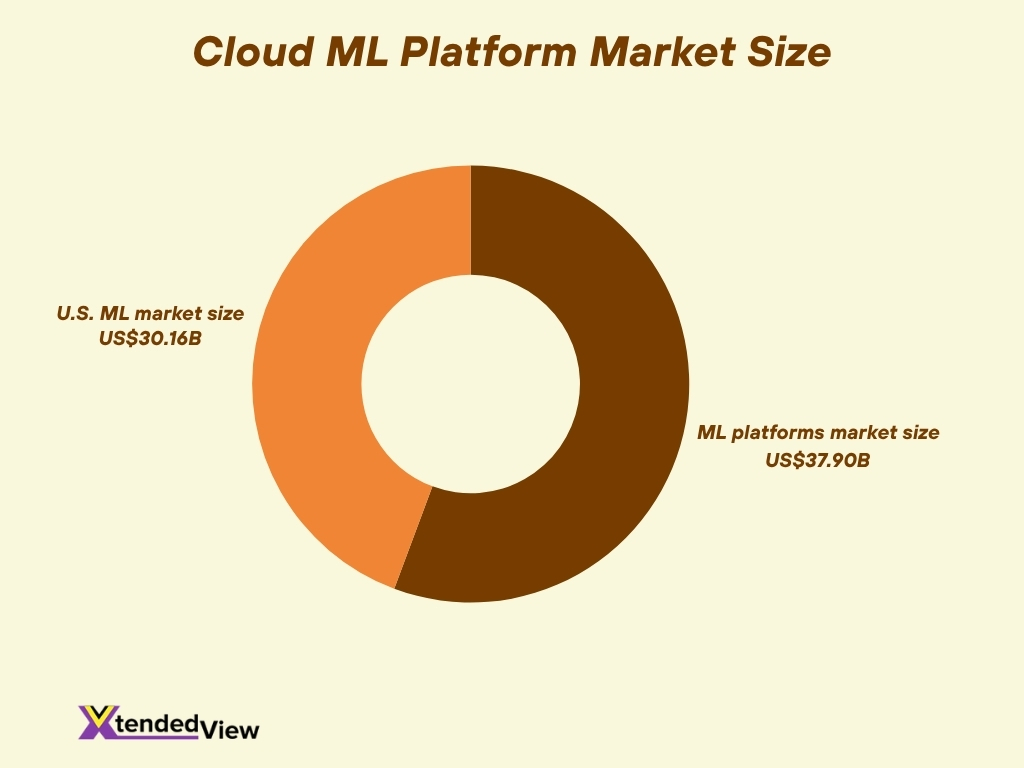

Market Share of Leading ML Software

- Global ML platforms market to grow by $37.9 billion between 2025–2029, at ~25.1% CAGR.

- The U.S. ML market is estimated at $30.16 billion.

- Europe and North America account for nearly 89% of the global ML market.

- Big players (Amazon SageMaker, Azure ML, Google Cloud AI) dominate enterprise ML software.

- SME adoption is increasing.

- Cloud‑native ML tools capture dominant market share.

- Platforms increasingly embed governance and MLOps.

Machine Learning in Healthcare

- ML applications in healthcare rose by 34% year‑over‑year in 2025.

- ML‑powered medical‑device market to grow to $8.17 billion in 2025.

- 66% of U.S. physicians use healthcare AI tools.

- Healthcare is the largest ML platform end‑user segment.

- FDA‑cleared ML medical devices are increasing.

- Integration and workflow challenges persist.

- The time to deploy healthcare ML models is often under 9 months.

Machine Learning in Banking and Finance

- 75% of real‑time transactions are monitored with ML‑based fraud systems.

- ML is used widely in credit scoring, trading, and segmentation.

- ML in finance moved from pilot to production.

- AML and compliance automation are key ML areas.

- ROI from ML in finance is among the highest by sector.

- Legacy integration and talent gaps remain.

- Regulatory demands require explainability and auditability.

Use of Machine Learning in Retail and E-Commerce

- Retailers spent $18.7 billion in 2025 on ML‑powered solutions.

- 55% of enterprise CRMs now use ML features like sentiment analysis.

- 61% of HR workflows in retail use ML for recruiting.

- Image‑recognition model accuracy reached 98.1%.

- Dynamic pricing and recommendations boost online sales.

- ML systems are deployed in 6–9 months.

- Cloud‑ML platforms lower the entry for smaller retailers.

Frequently Asked Questions (FAQs)

It is projected to reach $93.73 billion in 2025.

A CAGR of approximately 35.09% is forecast from 2025 to 2034.

About 78% of organisations now use AI/ML in at least one business function.

Together, they hold nearly 89% of the global machine learning market.

Approximately 75% of real‑time financial transactions will be monitored using ML‑based fraud systems.

Conclusion

The state of machine learning reflects both significant progress and persistent challenges. While adoption, data‑volume growth, and software‑platform maturity all show strong upward trends, issues such as data bias, talent shortages, and regulatory complexity continue to slow full‑scale deployment. For organisations in retail, finance, healthcare, and beyond, the successful path forward will hinge on building robust ML governance, embracing cloud‑native platforms, and continuously retraining models as data volumes surge.