Google Ads remains a central pillar in digital marketing, connecting businesses with consumers at the moment of intent. For example, a U.S. retailer might use Google Ads to surface their product to a user searching “best running shoes,” while a B2B software firm may deploy Google Ads to generate leads via targeted search ads. From e‑commerce to lead generation, its impact spans industries. Let’s explore the full picture.

Editor’s Choice

Here are seven standout statistics for Google Ads in 2025:

- Google Ads holds about 80% of the pay‑per‑click (PPC) market globally.

- Approximately 63% of people have clicked on a Google ad at least once.

- Businesses using Google Ads can expect $2 return for every $1 spent (i.e., 200% ROI) as a baseline.

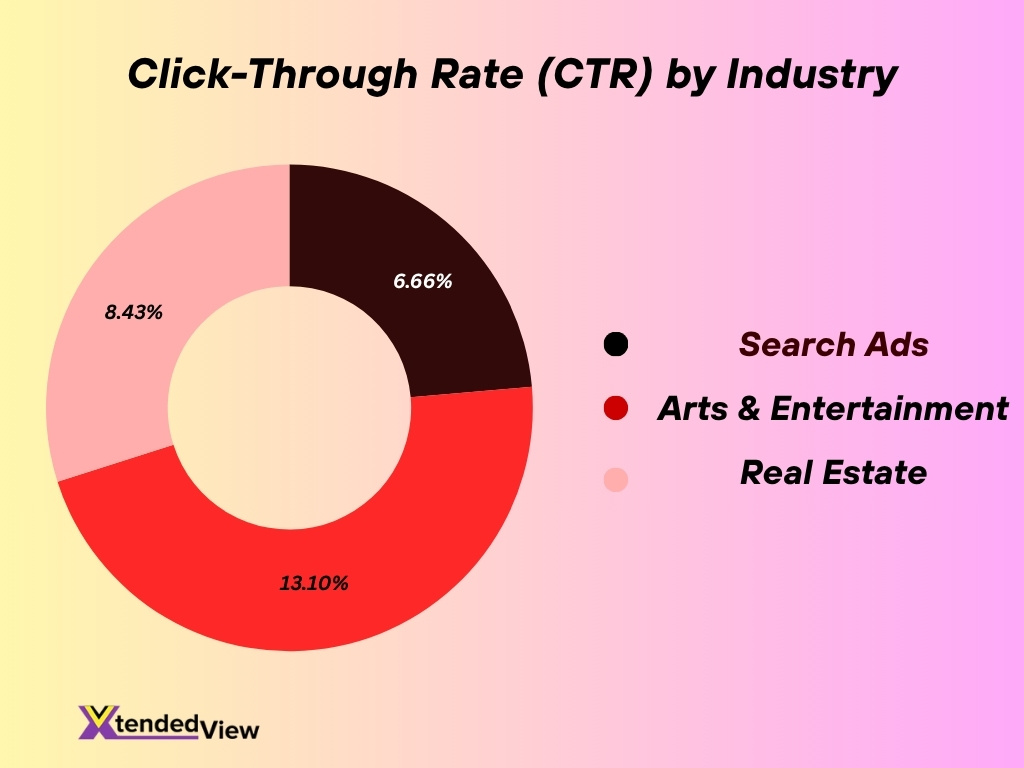

- Average click‑through rate (CTR) across search ads in 2025 hovers around 6.66%.

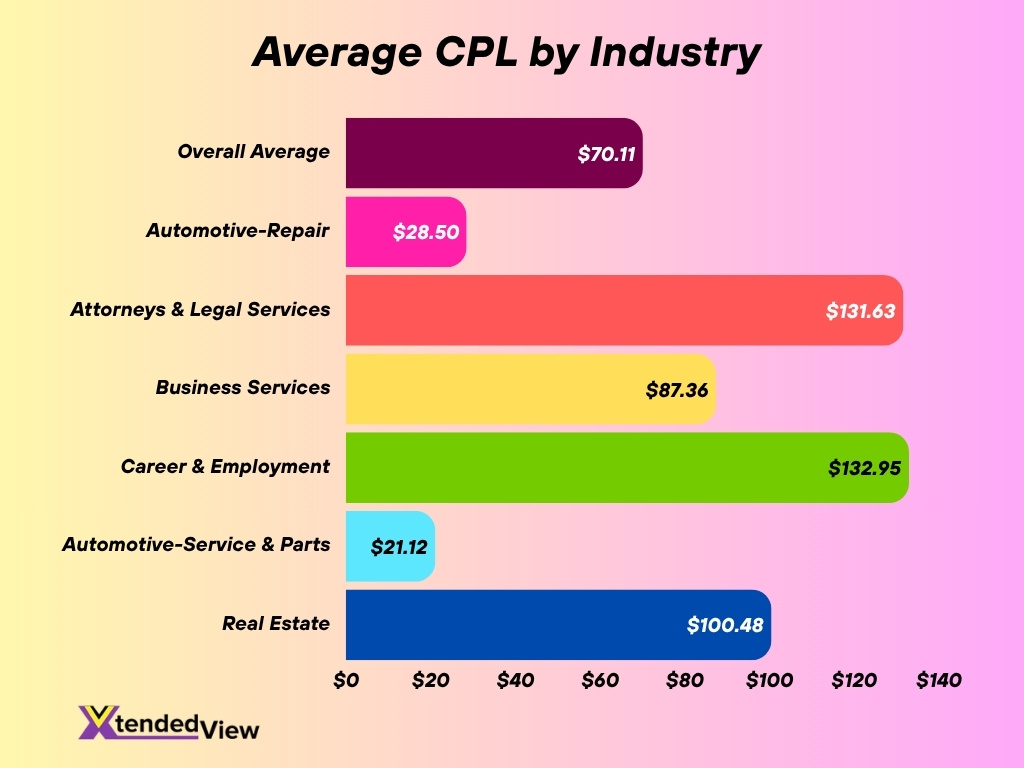

- Average cost‑per‑lead (CPL) has risen to $70.11 in 2025 across industries.

- In many industries, cost‑per‑click (CPC) increased by 13% year‑over‑year in 2025.

- In Q3 2024, Google’s ad revenue was approximately $65.9 billion; the first three quarters of 2024 tallied about $192.2 billion.

Recent Developments

- In May 2025, at Google Marketing Live, Google announced new AI‑powered campaign solutions under “Power Pack” to drive cross‑channel performance.

- Google updated the attribution and measurement framework, placing more emphasis on first‑party data and automation in mid‑2025.

- The platform made changes to landing page quality predictions, shifting focus from keyword relevance alone to end‑to‑end user journey metrics (e.g., navigation ease).

- Video campaigns such as Video Action have been folded into Demand Gen campaigns. New channel controls give advertisers more placement flexibility across YouTube, Discover, and Gmail.

- There is an increased push to integrate ads into AI‑driven search surfaces (e.g., AI Mode, AI Overviews), which opens up new ad‑format opportunities and raises measurement questions.

- Automation and machine‑learning features are now foundational for optimizing bidding, creatives, and targeting in Google Ads campaigns.

- Privacy changes and cookie deprecation continue to shape Google Ads strategy, requiring advertisers to rethink tracking, data sources, and measurement.

Google Ads Overview

- Google Ads is the online advertising platform from Google LLC that allows businesses to display ads across Search, Display, Shopping, YouTube, and partner networks.

- It works on a Pay‑Per‑Click (PPC) model, advertisers pay when someone clicks their ad.

- The key ad types in 2025 include: Search ads, Display ads, Shopping ads, Video/YouTube ads, App campaigns, and Local campaigns.

- The platform uses automated auctions to determine which ads appear, where, and at what cost, based on bid, expected impact, and quality.

- Quality Score remains relevant, but Google increasingly factors in landing‑page experience, user intent, and first‑party signals.

- Google Ads is heavily integrated across Google’s ecosystem, Search, YouTube, Google Display Network, Discover, and Gmail, which gives it a broad reach.

- For U.S. advertisers, particularly, Google Ads remains a bedrock tool for capturing active search intent and delivering conversions.

- Because of its global scale, many marketers use Google Ads as the baseline channel and then layer other platforms around it for awareness or diversification.

Key Google Ads Statistics

- Google Ads commands a market share of 80.20% of the PPC market in 2025.

- Around 63% of users have clicked on a Google ad at least once.

- The global reach of Google’s ad network is approximately 90% of internet users.

- The average CTR for Search ads in 2025 is about 6.66%, though this varies by industry.

- The average conversion rate across Google Ads campaigns is around 6.96% in 2025.

- The average CPC for U.S. search ads is approximately $4.66 (industry‑wide average) in 2025.

- In 2025, 87% of industry sectors experienced higher CPCs compared to 2024.

- Average CPL across industries rose from $66.69 in 2024 to $70.11 in 2025, a 5.13% increase.

- For 2023, Google’s ad revenue was about $237.855 billion.

- In the first three quarters of 2024, Google Ads generated about $192.2 billion in revenue.

Google Ads Market Share

- Google Ads holds roughly 80% of the PPC market share in 2025.

- In terms of global search engine market share, Google holds about 89–90%, which supports the ad platform’s dominance.

- The Google Display Network reaches over 2 million websites, videos, and apps.

- More than 65% of small to mid‑sized businesses (SMBs) use Google Ads for PPC campaigns.

- Google Ads captures a large portion of advertisers’ search ad budgets, with 80‑85% of PPC budgets allocated to Google in some studies.

- The Display network still plays a role, but the majority of market share is centered on Search and Shopping via Google.

- Because of its entrenched reach and integration, many competitors have a very small slice of the pure PPC market compared to Google.

- For advertisers seeking reach and intent‑based targeting, Google Ads remains the go‑to platform by market share alone.

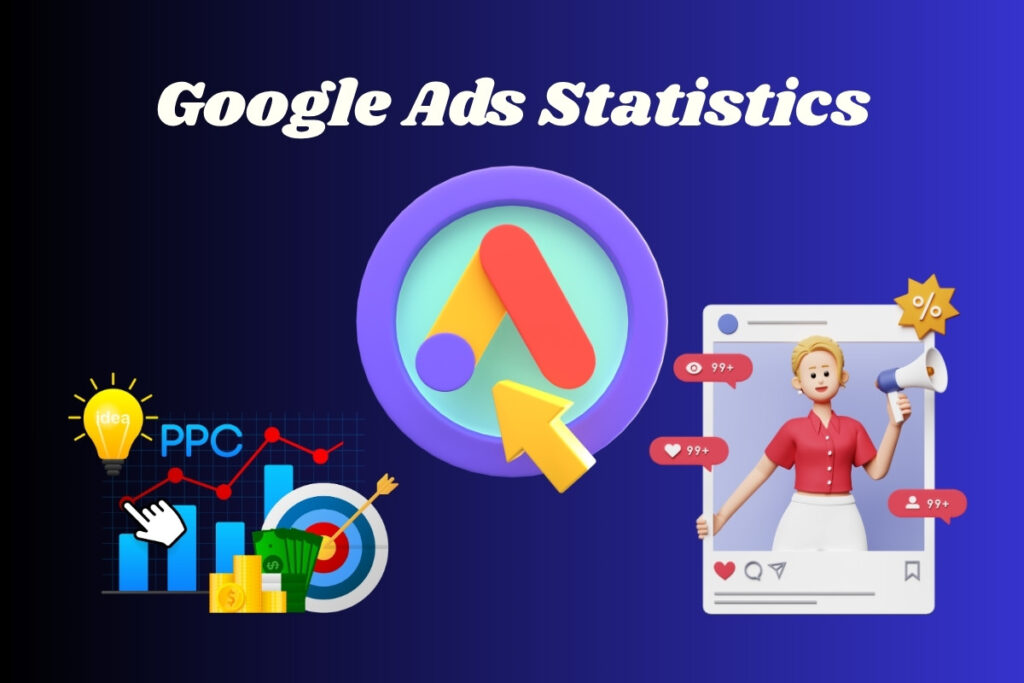

Google Ads Adoption by Businesses

- Around 80% of businesses worldwide are using Google Ads for PPC campaigns.

- About 65% of SMBs have active Google Ads campaigns.

- For U.S. advertisers, ad budgets often designate 70%+ of PPC spend to Google Ads vs other platforms.

- More than 96% of brands in some surveys are investing in Google Ads.

- The platform serves advertisers of all sizes, from solo entrepreneurs to major enterprises, thanks to flexible budget control and automation.

- Usage in the e‑commerce sector is particularly strong; many retailers adopt Google Shopping campaigns through Google Ads.

- Adoption drivers include breadth of reach, intent targeting via Search, and increasing automation capabilities in the platform.

- Barriers to adoption, rising costs (CPC/CPL increasing), increased competition, and complexity of campaign management (especially for smaller advertisers).

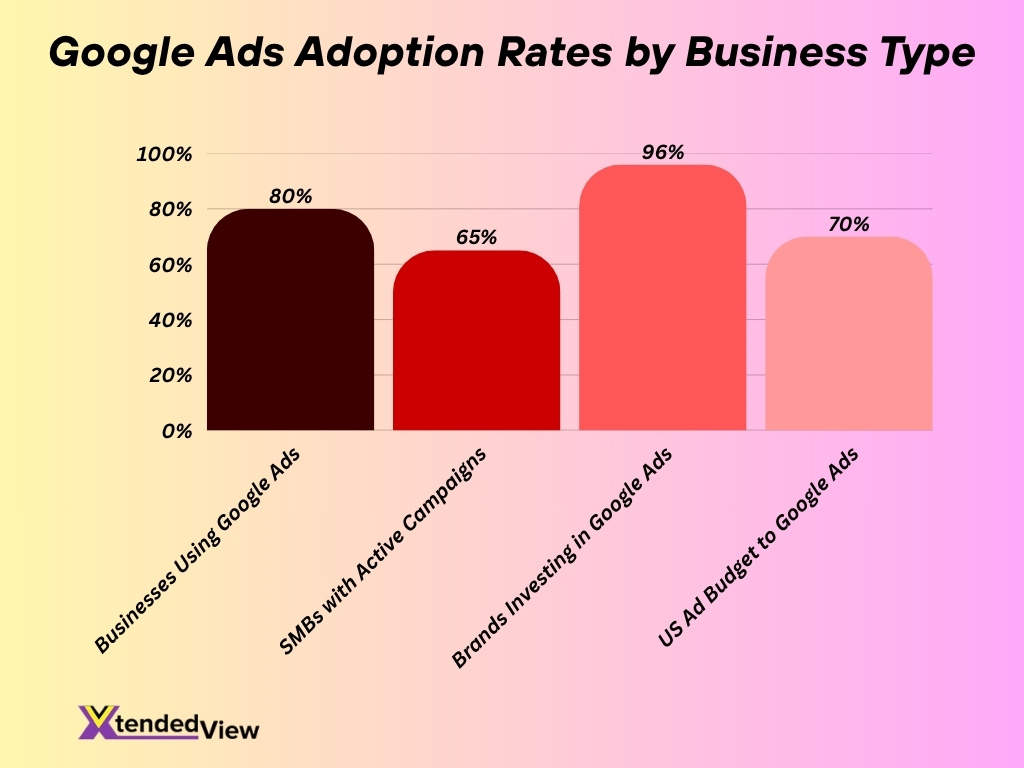

Google Ads Revenue & Growth

- Google’s ad revenue has shown consistent growth over the past decade.

- Revenue increased from $51.07 in 2013 to $237.86 in 2023, more than a 365% increase over 10 years.

- Major growth spikes occurred between:

- 2016 → 2017: $79.38B → $95.58B

- 2017 → 2018: $95.58B → $116.46B

- 2020 → 2021: $146.92 → $209.49 (largest jump in one year)

- Only slight revenue slowdowns occurred in:

- 2022 relative to 2021 (continued growth but slower pace: $209.49 → $224.47)

- Post-pandemic digital acceleration played a major role in the 2020–2023 surge.

- The upward trajectory highlights Google’s dominant position in the global digital advertising market.

- 2023 marks the highest revenue point in the timeline: $237.86B.

ROI from Google Ads

- Studies cite an average return on investment (ROI) of 2:1, meaning businesses earn $2 for every $1 spent on Google Ads.

- One benchmark shows an average conversion rate of 7.52% in 2025, suggesting stronger performance for many advertisers.

- In a ROI comparison between platforms, Google Ads achieved an average ROAS of 3.8:1 in Q1 and up to 4.2:1 long term, outperforming other platforms like Facebook (2.9:1).

- Some industries report much higher ROAS (e.g., legal services 6.2:1) when optimized effectively.

- Advertisers with strong campaign structure, targeting, and conversion tracking tend to significantly exceed the average ROI benchmarks.

- ROI performance remains tied to effective measurement practices and attribution models. For instance, better tracking of end‑to‑end conversions helps improve ROI.

- Given rising CPCs and competition, maintaining or improving ROI in 2025 demands tighter optimization and clearer conversion value tracking.

Google Display Network Reach

- The Google Display Network (GDN) comprises over 2 million websites, videos, and apps, offering massive reach.

- Google’s ad network touches over 90% of internet users worldwide, giving advertisers a broad scale.

- Many advertisers use both Search and Display through Google Ads to capture both intent‑based (Search) and awareness (Display) opportunities.

- Although Display often sees lower conversion than Search, its reach supports brand awareness and remarketing strategies.

- The breadth of placements means advertisers must manage placement and audience controls carefully to maintain efficiency.

- Display network ads help in cross‑device and cross‑platform reach, especially in mobile environments where app‑based inventory plays a role.

- Display campaigns often serve as an incremental channel alongside Search, rather than a replacement for high‑intent traffic.

- With automation and Audience tools in Google Ads, Display reach is increasingly integrated into full‑funnel strategies.

Mobile vs Desktop Google Ads Performance

- Mobile devices account for 52–60% of all PPC clicks in Google Ads campaigns in 2025.

- Mobile ads often achieve click‑through‑rates (CTR) in the 2–5% range, compared to 1–3% for desktop in certain benchmarks.

- In many industries, mobile conversion rates can be 2‑3 × higher than desktop when properly optimized.

- Advertisers report that younger demographics and on‑the‑go users contribute disproportionately via mobile ad engagements.

- For desktop ads, although the volume of clicks may be lower, user intent often tends to be more research‑oriented, meaning higher‑value actions in some contexts.

- Mobile ad bidding and user behaviour differ; shorter sessions, local intent, and quicker decision‑making dominate mobile.

- To optimize performance, advertisers must ensure mobile landing pages are fast, responsive, and tailored for the device.

- Depending on the industry, device mix strategies matter; high‑value B2B purchases may lean toward desktops, whereas impulse or local services may lean toward mobile.

Average Click‑Through Rate (CTR)

- For Search ads on Google in 2025, the average CTR is around 6.66%.

- In some verticals, such as Arts & Entertainment, CTRs have reached 13.10% in 2025.

- Across industries in 2024–2025, 70% of industries reported increases in CTR compared to preceding years.

- High‑intent keywords and tightly‑matched landing pages help drive above‑average CTRs.

- Display‑network CTRs remain significantly lower than Search, thus CTR benchmarks need to be device and channel‑specific.

- Improving ad relevance, use of extensions, and strong creative contribute to higher CTRs under Google Ads.

- CTR remains one of the key signals in Google Ads’ auction; better CTRs often help lower CPCs.

- Regular benchmarking of CTR by the industry is vital; misuse of broad keywords or weak creatives often leads to below‑average CTRs.

Average Cost Per Click (CPC)

- The average CPC in Google Ads is $5.26 in 2025.

- Average industry CPCs vary: Attorneys & Legal Services $8.58, Dentists & Home Improvement $7.85, Education $6.23.

- Business‑wide average CPC rose by 12.9% YoY in 2025 across industries.

- Search‑network CPCs are around $2.69, though dependent on device, region, and competition.

- Competitive keywords and high‑value verticals continue to push CPCs upward, requiring advertisers to prioritize efficiency.

- Location, device, ad rank, and Quality Score all influence CPC; higher ad relevance typically reduces CPC.

- With CPCs rising, controlling cost per conversion and optimizing for conversion value (not just clicks) becomes crucial.

- Given the rising costs, advertisers are shifting more budget toward higher‑intent placements and automated bidding strategies to maintain ROI.

Average Conversion Rate

- The reported average conversion rate (CVR) across industries for Google Ads in 2025 is 7.52%, up approximately 6.84 % year‑over‑year.

- Broad‑average CVR ranges between 2%‑5% across industries in 2025.

- In many service industries (e.g., home services, legal), conversion rates surpass 10% when well‑optimized.

- For the Display network component of Google Ads, average conversion rates tend to remain below 1%, reflecting lower‑intent placements.

- Conversion performance varies significantly by funnel depth; higher‑intent keywords and strong landing pages correlate with higher CVRs.

- The median cost per conversion was $30.57 in April 2025, indicating cost efficiency for conversions in certain cases.

- Real‑estate industry benchmark, conversion rate about 3.28% in 2025, which is below the broader average.

- Advertisers who track offline conversions, value per conversion, and quality signals tend to maintain or improve conversion rates despite rising costs.

Average Cost Per Lead (CPL)

- The average CPL across industries for Google Ads was $70.11, up about 5.13% YoY.

- The lowest average CPL industry was Automotive‑Repair at $28.50, while the highest average CPL industries included Attorneys & Legal Services at $131.63.

- Typical cost per lead across 30 industries, average CPL $53.52, but varying widely by industry.

- For ecommerce campaigns (search ads), the average cost per action (CPA) was reported at $45.27 in 2025.

- Many businesses reported that despite cost increases, lead cost increases were leveling off in 2025 relative to previous years.

- Cost per conversion (which approximates CPL for many) median figure of $30.57 in April 2025 shows variance across campaign types and industries.

- Higher‑value B2B or service‑industry leads continue to carry significantly higher CPLs than more transactional ecommerce campaigns.

- Advertisers emphasise measuring lead quality in addition to cost per lead, because a low‑cost lead with poor quality can undermine ROI.

Benchmarks by Industry

- The average search‑ad CTR varies markedly by industry; the benchmark for Search ads is 6.66% overall.

- Some sectors show notably higher CTRs; for example, Arts & Entertainment achieved 13.10% average in 2025.

- Average CPC by industry in 2025, for Attorneys & Legal Services average CPC was $8.58, for Arts & Entertainment $1.60.

- CPL by industry, Business Services $87.36, Career & Employment $132.95, Automotive‑Service & Parts $21.12.

- Conversion rate by industry: the median conversion rate across fourteen industries was 2.9%, indicating that many industries perform below the headline average.

- In ecommerce, 18% of all ecommerce revenue, in some cases, is directly attributed to Google Ads campaigns.

- Real‑estate industry, average CPC $2.53, CTR 8.43%, conversion rate 3.28%, CPL $100.48.

- Advertisement costs (CPC) increased in 87% of industries in 2025, with an average CPC increase 12.9% YoY.

Google Shopping Ads Statistics

- For Google Shopping Ads in 2025, the average click‑through rate (CTR) is 0.86%.

- The average conversion rate for Shopping Ads is around 1.91%.

- Advertisers spent $770.41 per month on average on Google Shopping campaigns.

- Shopping Ads account for approximately 76.4% of all retail search ad spend in the U.S. and 85.3% of all clicks in Google Ads + Shopping campaigns.

- The typical cost‑per‑click (CPC) for Shopping Ads is approximately $0.66.

- Shopping Ads tend to have lower CPCs and CTRs than Search Ads, but often target higher‑intent product search terms, which can improve ROI.

- Advertisers focusing on retail or ecommerce should optimise feed management, product titles, descriptions, and bidding on Shopping campaigns to capitalise on this channel.

Global Ad Spend & Trend Projections

- Global advertising spend is projected to reach approximately $1.1 trillion in 2025.

- Digital advertising will account for around 75.2% of global ad spend in 2025, approximately $777 billion.

- Search ad spend growth for 2025 is forecast at around +8.3%.

- Ad revenue from Google and YouTube is forecast to exceed $200 billion in 2025.

- In Q1 2025, spending on Google Search ads grew 9% YoY, driven more by cost increases than click volume.

- Some media groups revised global advertising revenue growth forecasts downward to 6% for 2025 due to macroeconomic concerns.

- The shift toward mobile, programmatic display, AI‑first bidding, and diversification beyond traditional search is altering spend patterns across digital advertising.

- For U.S. marketers, controlling rising ad costs and optimising for conversions rather than clicks is becoming a key theme in 2025.

Google Ads vs Other Ad Platforms

- In a 2025 ROI comparison between Google Ads and Facebook Ads, Google delivered 20‑30% higher ROI for high‑intent search campaigns.

- Google retains a dominant position in search advertising, controlling over 92% of the global search market share.

- Meta (Facebook and Instagram) excels with awareness and visual‑driven campaigns, while Google is considered better for conversion‑oriented search ad campaigns.

- Budget allocation studies suggest that for small businesses, approximately 70% of PPC budget is spent on Google Ads and 30% on Facebook in 2025.

- Google’s CPC and CPA tend to be higher than many social‑platform equivalents due to competitive intent keywords, but user intent is stronger.

- Some brands report that combining Google Ads and Facebook Ads leads to 67% higher ROAS than using one platform alone.

- Marketers emphasise selecting the right platform for the right stage: Google for intent and conversions, Facebook or Instagram for discovery and branding.

Google Ads Future Trends

- As of 2025, the rise in machine‑learning bidding, creative automation, and full‑funnel attribution is accelerating; advertisers report that this is essential to maintain efficiency under rising costs.

- With privacy changes and cookie deprecation, more emphasis is on first‑party data, conversion modelling, and feed optimisation across Google Ads.

- Adoption of Google’s Performance Max (PMAX) campaign type continues, enabling multi‑channel coverage across Search, Shopping, Display, YouTube, and Discover, but requires new measurement frameworks.

- The role of Shopping Ads and retail‑media placements within Google’s ecosystem is becoming more central to the advertising mix, especially for e-commerce.

- With the evolution of search (voice assistants, AI summaries, visual search), advertisers will need to adapt how they target and bid in Google Ads.

- Because CPC and CPL benchmarks are rising, future success will hinge on tighter optimisation, higher conversion rates, and leveraging automation to handle scale.

- As campaigns span multiple Google platforms and other media, building integrated measurement systems to capture full customer journeys will become a key differentiator.

Frequently Asked Questions (FAQs)

The average CPC is ≈ $5.26 across all industries.

The average conversion rate is ≈ 7.52% across industries.

Google Ads holds about 80.20% of the pay‑per‑click market.

Approximately 87% of industry sectors experienced higher CPCs in 2025.

The average CTR for Shopping Ads is ≈ 0.86%.

Conclusion

The Google Ads platform continues to hold a commanding place in digital advertising, with strong benchmarks for conversion rates, broad business adoption, and deep market reach. At the same time, metrics such as cost per click, cost per lead, and competition levels are rising, meaning that maintaining performance requires sharper strategies, better measurements, and smarter use of automation.

Whether you are in ecommerce, services, or B2B, aligning your campaigns around high‑intent keywords, optimised landing pages, and full‑funnel tracking will separate the winners from the rest.